2024 Life Insurance Trends: Closing the Coverage Gap

Bridging the Life Insurance Gap: Insights from the 2024 Insurance Barometer Study

In today's uncertain world, ensuring financial security for our loved ones is more crucial than ever. The 2024 Insurance Barometer Study, conducted by Life Happens and LIMRA, sheds light on a significant concern: a growing number of Americans recognize their need for life insurance but have yet to take action.

Key Findings:

Rising Awareness but Limited Action: Approximately 42% of American adults, equating to 102 million individuals, acknowledge they need life insurance or additional coverage. Notably, 37% express an intention to purchase a policy within the next year.

Middle-Income Households at Risk: Middle-income Americans, defined as those with household incomes between $50,000 and $149,999, represent a significant segment with unmet life insurance needs. Four in ten individuals in this group, or 50 million adults, admit to having a coverage gap. Encouragingly, 54% of this demographic indicate a desire to obtain life insurance in the near future.

Misconceptions About Cost: A prevailing barrier to obtaining life insurance is the misconception about its affordability. The study reveals that 72% of Americans overestimate the cost of a basic term life insurance policy, with younger adults often assuming it's three times more expensive than it actually is. This misjudgment leads to hesitation and inaction.

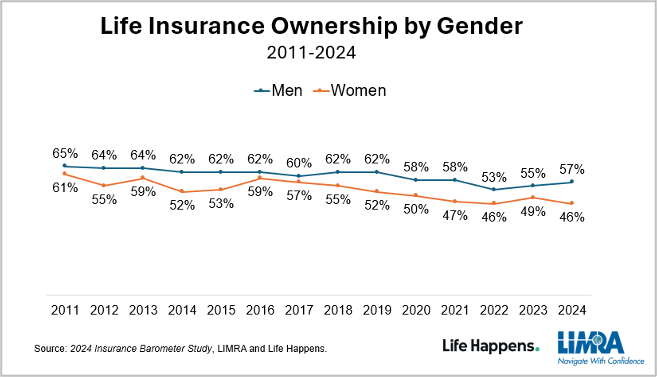

Gender Disparities in Coverage: There's a notable difference in life insurance ownership between men and women. In 2024, 46% of women reported having life insurance compared to 57% of men. This 11-point gap is the largest observed in the study's 14-year history. Additionally, 45% of women, representing 54 million individuals, acknowledge a coverage gap, and 36% plan to address this need within the year.

Addressing the Challenges:

The study underscores a significant knowledge gap: 44% of respondents admit to being only somewhat or not knowledgeable about life insurance. This lack of understanding, combined with cost misconceptions, prevents many from securing the coverage they need. To bridge this gap, it's essential to provide clear, accessible information about the benefits and true costs of life insurance. Engaging with trusted financial professionals can demystify the process and highlight the importance of timely coverage.

Conclusion:

Life insurance is a cornerstone of financial planning, offering peace of mind and protection for families. By dispelling myths and providing accurate information, we can empower more Americans to make informed decisions, ensuring their loved ones are safeguarded against unforeseen circumstances.

Source: 2024 Insurance Barometer Study by Life Happens and LIMRA